Monrovia – In this second of a three-part series on the survival of the National Oil Company of Liberia (NOCAL) amid financial turmoil and the oil crisis we look closely at how the company is operating in these difficult times.

NOCAL is cash-strapped and is no longer leading the promising Liberian oil and gas sector as it did in 2012. With no sales of seismic data and the prices of oil on the world market still around US$50 per barrel, the Liberian oil and gas industry is left mere aspirations and fading dreams.

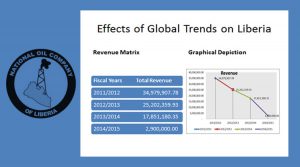

Be careful to keep your writing simple and straight forward. Too many words and thoughts can cloud your meaning. Clear, direct, simple is our goal.NOCAL’s last contribution to a Liberian national budget was a meager US$3.3 million in the 2014/2015 fiscal year. That is far less than the US$82.07 million generated by the sector in 2012/13, according to the Liberia Extractive Industry Transparency Initiative.President Ellen Johnson Sirleaf in 2015 instituted a number of measures aimed at reviving the financially troubled company. She set up a new interim management team, retired the board of directors of the company and mandated the reduction of its staff from 160 to 50.

NOCAL did not make any contribution to the 2015/2016 national budget and will not in the current fiscal year’s budget that is still before the Legislature for passage. No severance benefit had been paid to former executives when NOCAL’s interim President and chief executive officer Cllr. Althea Sherman last spoke on the matter in May, nor had laid off staff been paid their full severance entitlements. “The oil crisis has not abated and as a consequence, NOCAL continues to have financial challenges,” Cllr. Sherman said in May referring to some 25 staff who had not received the second scheduled severance pay.Meanwhile, laid off NOCAL staff is still awaiting the third scheduled severance payment that should have been paid since July.NOCAL now survives through a last-gasp financial, disciplinary mechanism with a range of reduced spending as well as a halt of all of its corporate social responsibilities, sources told FrontPage Africa.

“In the wake of the continuing oil price crisis, all industry participants (including NOCAL) continue to face financial challenges and limited investor interest.

However, due to implementation of a strategy that includes aggressive cash flow and financial resources management, the Interim Management Team and I have been able to ensure on-going operations at the institution,” Cllr. Sherman said in a statement.

She declined to comment on the specific strategies being implemented, citing an ongoing audit of NOCAL by the General Auditing Commission. She said it “would be inappropriate to provide details related to our finances prior to the conclusion of the audit.”

Many parties have called for an audit of NOCAL since it was made known that the institution was in financial turmoil —including former NOCAL President Christopher Neyor, the Legislature, civil society and ordinary citizens. I

n Liberia’s fiercely combative political climate many have blamed, Robert Sirleaf, the son of the President who was the chairman of NOCAL from 2012 to 2013, for NOCAL’s woes though there has never been any official case made against him in relation to NOCAL’s troubles.

Liberians across the country are trying to understand what happened to a company whose promising future became synonymous with the new prosperous future Liberians yearned for.

The misfortune and ineptitude of NOCAL has not only led to public mistrust but also to a lack of sympathy and empathy for the company.

“My concern at the time, and which remains my concern today, is that if we had found oil and we had seen US$2 billion to US$3 billion coming into our national economy year-on-year, the damage it would have caused would have been a serious problem for this country,” Silas Siakor said in June in reference to the boom of NOCAL being a curse, not a blessing.

Earlier in May, former Minister of Finance Prof. Wilson Tarpeh said: “What happened at NOCAL was a state enterprise that got too big for what it was supposed to do. It got too big and it got too ambitious.

Their expenditure profile grew beyond its reachability. They set up a grandiose system which was probably not necessary. It was not anticipatory of the future…”

The Liberian oil basin will be empty of exploration companies by the second half of 2018 if new production sharing contracts (PSCs) are not signed or existing ones not extended.

Currently, only Chevron, African Petroleum and ExxonMobil are operating in the basin. Six out of 10 offshore blocks are still be held by African Petroleum (blocks 8 and 9), ExxonMobil (block 13) and Chevron (blocks 11, 12 and 14).

Two of the six blocks—Chevron’s blocks 11 and 12—have already expired. Four blocks have already been relinquished—Anadarko (block 10 and 15) and Repsol & Tullow (blocks 16 and 17).

NOCAL now depends on the three companies for survival, as well as the future of the oil industry to say the least. ExxonMobil contributed more than US$1.2 million to the government in fiscal year 2014/2015, while Chevron contributed US$8.3 million, according to LEITI.

A 2015 legislative hearing on the bankruptcy of NOCAL found that oil companies spent US$1 billion drilling just nine wells in the Liberian basin. They cannot afford to continue drilling with the price of around US$50 per barrel of on global markets.

This problem is not just with Liberia. The number of drills operating in the basins of African countries has reduced by five (87 – 82) this month from last month and by 12 from last year (94 – 82), according to the group WTRG Economics, which conducts a periodic rig count. Baker Huge, an American industrial service company, puts the global decline in the number of rigs from 2015 to 2016 at 200.

Only ExxonMobil and Chevron have PSCs that will take them into the first half of 2018. African Petroleum’s PSC for its two blocks ran out since June 23 this year.

It could extend operations by another four years in accordance with its contract as it is the only company in the history of the Liberian oil basin to have discovered oil in its Narina-1 well of block 9 in 2012. ExxonMobil said in 2015 it will drill for oil not later than September 2017.

Things could have been a little better for NOCAL as Kosmos, the American company that discovered oil in the Ghanaian oil basin in 2007, expressed interest in Repsol & Tullow relinquished blocks 16 and 17 at a 2014 bid round but it did not materialize.

Several factors played out in the failed Kosmos deal as Cllr. Sherman herself put it: “One key lesson is to acknowledge the importance of providing an investor friendly business environment as we have limited control over the decisions made by potential investors.”

The draft Petroleum (Exploration and Production) Law has been passed by the Legislature and is now before the Senate. It replaces the 2002 Petroleum Law of Liberia, and is intended to bring much needed reform to the Liberian oil and gas industry.

As well it creates a regulator and retains NOCAL but as a negotiator for the state’s stake in PSCs, it maintains standard state equity shares in PSCs, royalties and surface rental fees, which some experts here say will attract more players to the Liberian basin and avoid a total decay of NOCAL.

“The matter of fact is if we start to have more players going into the area, there is high chance of us making discovery [of oil in commercial quantity],” said Urias Taylor, a petroleum engineer who worked at NOCAL between 2011 when the company blossomed and 2015 when it got into the red.

“You have a history of limited people participating in offshore drilling activities but later on when the number started increasing the chances of uncertainty started reducing,” Taylor said the Liberian oil basin was not the same as the Brazilian basin, though both countries share geological features.

The latter, he said, has a larger drainage area for sediment deposition of fossil—that contains hydrocarbon, the building block of oil—due to the size of the Amazon River as compared to the former. He said even Ghana, where oil was discovered in 2007, has a larger drainage area than Liberia, which he said is a variable that had to play in Liberia’s negotiation with oil companies.

“They (NOCAL) have to be very flexible. The geology of the Liberian offshore basin is a little bit more complex,” he advised.

By James Harding Giahyue / Story was produced in collaboration with the Thomson Reuters Foundation/New Narratives Liberia Oil Reporting Project, which is part of the Foundation’s pan-African programme Wealth of Nations / More